Credit Unions Cheyenne WY: Top Quality Banking Solutions for every single Stage of Life

Credit Unions Cheyenne WY: Top Quality Banking Solutions for every single Stage of Life

Blog Article

Why Signing Up With a Federal Lending Institution Is a Smart Option

Joining a Federal Credit Union stands for a calculated financial action with various benefits that cater to people seeking an extra community-oriented and individualized banking experience. By exploring the one-of-a-kind offerings of Federal Credit score Unions, people can touch into a globe of financial empowerment and connection that goes beyond typical banking solutions.

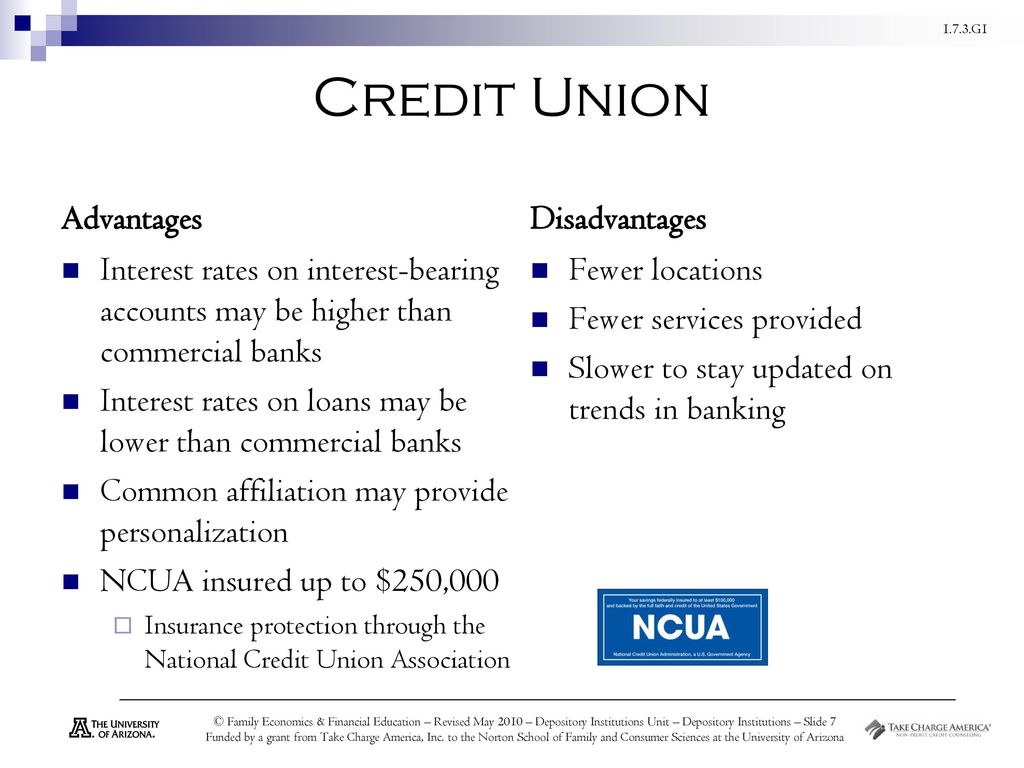

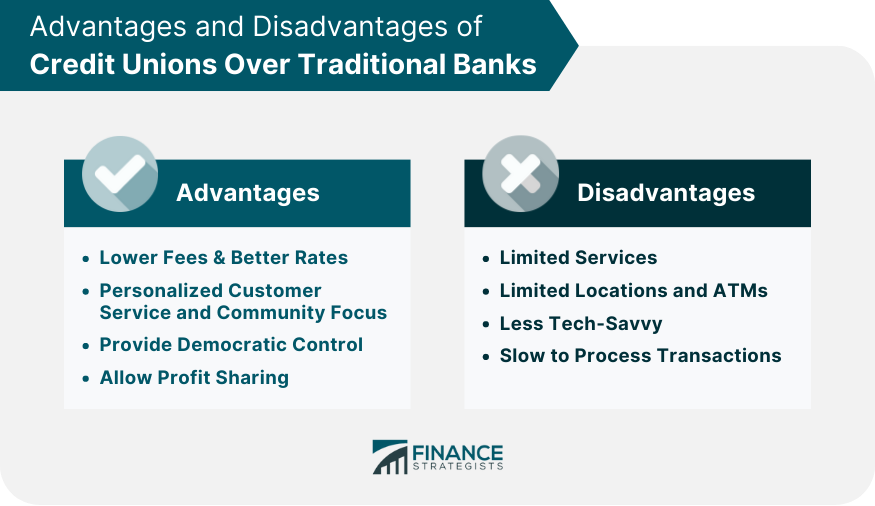

Reduced Costs and Competitive Rates

Additionally, government credit history unions commonly give more competitive rate of interest on cost savings accounts and car loans compared to conventional banks. By focusing on the monetary wellness of their members, cooperative credit union can provide higher passion rates on cost savings items, assisting people expand their money faster. On the loaning side, lending institution often tend to have reduced passion rates on financings, consisting of mortgages, car finances, and individual car loans, making it much more budget friendly for participants to accessibility credit scores when needed. Signing up with a government cooperative credit union can thus lead to significant cost savings and economic benefits for individuals looking for an extra member-centric banking experience.

Concentrate On Member Fulfillment

Federal credit score unions prioritize member satisfaction by customizing their monetary products and services to fulfill the one-of-a-kind requirements and preferences of their members. Unlike conventional financial institutions, federal credit score unions run as not-for-profit companies, permitting them to focus on giving outstanding solution to their members rather than maximizing revenues.

By maintaining the ideal interests of their participants at heart, credit history unions create an extra favorable and fulfilling financial experience. By choosing to sign up with a government credit rating union, people can profit from an economic organization that really cares regarding their health and economic success.

Community-Oriented Method

Highlighting neighborhood engagement and local effect, government lending institution show a dedication to serving the demands of their surrounding areas. Unlike standard financial institutions, government lending institution run as not-for-profit companies, enabling them to concentrate on benefiting their neighborhoods and members as opposed to maximizing earnings. This community-oriented approach is noticeable in numerous aspects of their procedures.

Federal lending institution commonly focus on offering financial solutions tailored to the specific demands of the regional neighborhood. By comprehending the unique obstacles and opportunities present in the areas they serve, these cooperative credit union can give even more accessible and individualized financial solutions. This targeted technique fosters a feeling of belonging and depend on among community participants, enhancing the bond between the cooperative credit union and its components.

Additionally, government lending institution often take part in neighborhood advancement initiatives, such as sustaining neighborhood businesses, sponsoring events, and advertising economic literacy programs. These initiatives not only add to the economic development and stability of the community however likewise demonstrate the cooperative credit union's devotion to making a positive impact beyond just financial services. By actively getting involved in community-oriented tasks, federal cooperative credit union develop themselves as pillars of assistance and campaigning for within their areas.

Accessibility to Financial Education

With a focus on empowering participants with necessary financial expertise and abilities, government lending institution focus on giving extensive and obtainable financial education programs. These programs are developed to furnish members with the tools they require to make informed choices regarding their funds, such as budgeting, conserving, investing, and credit scores monitoring. By providing workshops, workshops, on the internet resources, and individually counseling, go to my blog government lending institution ensure that their members have access to a variety of instructional you can try this out opportunities.

Financial education is vital in helping people browse the intricacies of individual finance and attain their lasting monetary goals. Federal cooperative credit union comprehend the importance of financial literacy in advertising economic health and security among their participants. By offering these educational resources, they equip individuals to take control of their financial futures and develop a solid foundation for monetary success.

Improved Customer Care

Members of federal credit unions often experience a greater level of tailored solution, as these institutions prioritize personalized focus and assistance. Whether it's assisting with account monitoring, supplying financial advice, or attending to problems without delay, government debt unions make every effort to exceed member assumptions.

One trick element of boosted client service in federal credit rating unions is the emphasis on structure long-term relationships with participants. By taking the time to recognize participants' economic objectives and offering tailored options, cooperative credit union can give meaningful assistance that surpasses transactional interactions. In addition, federal credit scores unions normally have a strong neighborhood emphasis, more enhancing the level of client service by promoting a sense of belonging and connection among members.

Conclusion

To conclude, joining a Federal Credit report Union provides various advantages such as lower charges, affordable rates, personalized service, and accessibility to monetary education and learning (Credit Unions Cheyenne). With a concentrate on member complete satisfaction and area engagement, lending institution focus on the financial wellness of their participants. By picking to be her comment is here part of a Federal Credit Union, people can delight in a customer-centric approach to financial that promotes solid community connections and encourages them to make educated financial decisions

On the borrowing side, debt unions often tend to have reduced rate of interest prices on car loans, consisting of home mortgages, car finances, and individual car loans, making it more cost effective for members to accessibility credit rating when required.Federal credit history unions focus on participant contentment by tailoring their monetary products and services to meet the unique needs and choices of their participants.With an emphasis on empowering members with vital financial knowledge and skills, government credit unions focus on offering thorough and easily accessible economic education and learning programs. Federal debt unions comprehend the relevance of economic literacy in advertising economic health and security among their members. With an emphasis on participant complete satisfaction and community involvement, credit scores unions prioritize the economic health of their participants.

Report this page